15 October, 2002

I cannot think of a worse financial situation to be in than to have been retired and heavily invested in the stock market during the years 2000, 2001, and 2002. From the end of March 2000 to the end of September 2002 the Dow Jones fell 30%, the S&P500 45%, the NASDAQ 75%, and the EAFE 50%.

Imagine the pain of a retired person who had gone to see a financial planner or investment advisor at the beginning of 2000 and been told that, if they stayed invested in the stock market, their portfolio could support them throughout retirement – based upon a historical 10% yearly stock market return. Three years later, their portfolio cut in half, what rate of return would they now require? This example underlines the danger of a simplistic investment strategy.

You should be aware that many sales people in the financial services industry use a so-called “financial plan” merely as a tool to sell additional investment products or services. If your financial advisor’s plan seems too simple to be true, or depends upon simplistic approximations and considers only idealized scenarios, then you should consider a second opinion from an independent Certified Financial Planner™ professional.

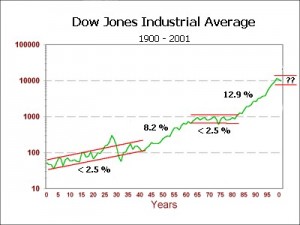

It is important to appreciate, that while it is true the US stock market has historically gone up at an average rate of about 10% per year, there have been several occasions when the market has “corrected”, sometimes over periods of many years. From 1900 to 1940 the Dow Jones went up at a rate of less than 2.5% per year, the same is true for the period 1962 to 1982. In between those times, the Dow rose at just over 8% per year in the 40’s and 50’s and at almost 13% over the last 20 years.

Please be careful when planning your financial future about assuming a constant rate of return. Make sure that your financial advisor has the necessary expertise to get you through the rough patches – anyone can be a financial advisor when the market is going straight up. Does your advisor have a strategy for when the market is not cooperating? This strategy may be as simple as staying out of the market altogether, or it may involve a shift in asset allocation, or it may be a market neutral strategy; whatever the approach, make sure it makes sense to you and don’t be afraid to get a second opinion.

If you have a lot at stake and are uncertain about a strategy that has been proposed to you, please give me a call or send me an email. Although my time is limited and my first duty is to my clients, time permitting I would be happy to discuss the pros and cons of any strategy with you.